by CCBlogAdmin

Share

by CCBlogAdmin

Share

The move would be a challenge to the U.S. dollar, which has dominated as the medium of exchange for the oil trade for decades.

Saudi Arabia is in discussions with Beijing about pricing some Saudi oil sales to China in yuan instead of dollars, according to a Wall Street Journal report, citing people familiar with the matter.

- Chatter about this sort of arrangement has been ongoing for several years, but recent events have brought a new urgency to talks, according to the report, which says the Saudis are questioning longstanding U.S. security commitments to the kingdom.

- Among the issues are what the Saudis believe to be less-than-enthusiastic support for the war in Yemen, the White House’s attempt at an Iran nuclear deal, and shock at the American withdrawal from Afghanistan, the report said.

- China is a buyer of more than 25% of saudi arabia exported oil, according to the story.

- The news would seemingly be of interest to the bitcoin (BTC) and gold markets, but, for now, there’s a little reaction, with the price of bitcoin staying in the mid-$38,000 area, and gold remaining lower by 2.1% for the day at $1,918 per ounce

- The news would seemingly be of interest to the bitcoin (BTC) and gold markets, but, for now, there’s a little reaction, with the price of bitcoin staying in the mid-$38,000 area, and gold remaining lower by 2.1% for the day at $1,918 per ounce.

From Coindesk: FedNow to debut in less than a year (Jesse Hamilton/CoinDesk) The U.S. Federal Reserve has tightened the window for the launch of its FedNow instant payments platform to between May and July of 2023. According to a press release, FedNow will be open to financial institutions of any size, allowing them to facilitate instant […]

From: zerohedge Goldman has reportedly offered its first ever lending facility backed by BTC as the Wall Street giant deepens its Bitcoin offerings. Goldman Sachs has offered its first bitcoin-backed loan. The arrangement, made popular over the past few years in the Bitcoin industry by newer companies, enables a bitcoin holder to obtain fiat money […]

By Jorge Vilches for the Saker Blog Russia is currently “defaulting” or — in the best of cases — on a very direct and firm path to an inevitable “default”. Or at least this seems to be what the Western press and international rating agencies are pushing and rooting for, same as specialized academia, think-tanks, […]

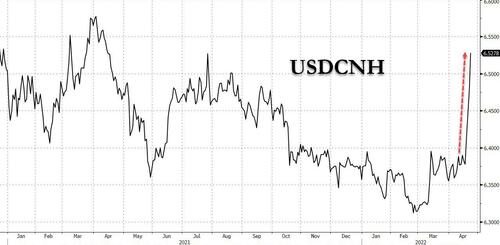

From: zerohedge Three weeks ago, when we predicted that the Yen was about to suffer a “downward spiral” (which it did, and prompted the BOJ to beg Yellen for coordinated currency intervention, only to be denied by the Treasury Secretary who is terrified of what importing even more inflation would mean for Biden’s catastrophic approval […]