by currencycentr1

Share

by currencycentr1

Share

From: zero hedge

On Tuesday 26 April in an interview with the newspaper Rossiyskaya Gazeta (RG), the Secretary of the Russian Federation’s Security Council, Nikolai Patrushev, said that Russian experts are working on a project to back the Russian ruble with gold and other commodities.

The interview, which is in Russian, can be seen on the RG website here.

For those who don’t know the name Nikolai Patrushev, Patrushev is one of Russia’s most powerful security/intelligence officers and a close ally of Putin. After serving between 1999 and 2008 as Director of the Russian Federal Security Service (FSB) (the successor organization to the KGB), Patrushev moved to be Secretary of the Russian Security Council in 2008. Patrushev took over as Director of the FSB in 1999 from the previous incumbent, Vladimir Putin.

The Security Council of the Russian Federation is chaired by Putin, with Patrushev as Secretary, overseeing the Security Council and answering directly to Putin. The deputy chairman of the Security Council is Medvedev Dmitry, the former Russian president, and prime minister. Among the other member of the Security Council are current Russian prime minister Mikhail Mishustin, and Russian foreign minister Sergei Lavrov.

So when Nikolai Patrushev says that Russia is working on a plan to back the ruble with gold and commodities, it is not just anyone saying this, it is being said by the highest echelons of the Russian Government.

Media coverage (in English) of Patrushev’s 26 April comments can be seen on the Russia Today (RT.com) website here. For those who cannot access RT.com due to it being locally blocked and who don’t want to use a VPN, the RT.com article can be seen on the ‘thethreadtimes.com’ website here.

Intrinsic Value

Since it’s good to go right back to the source of Rossiyskaya Gazeta (RG), I have added an English translation of the relevant sections of Patrushev’s interview with RG (using Yandex Translate) below.

RG Question:

Nikolai Patrushev: “

So there you have it. The Russian Government is actively working on creating a bar of gold and commodity-backed Russian ruble with an intrinsic value that is outside the orbit of the US dollar.

For the above paragraphs, Google Translate produces a nearly identical translation into English as Yandex Translate does, except whereas Yandex calls it an ‘a two-circuit monetary and financial system’, Google says a ‘dual-loop monetary and financial system’. ‘Two-circuit’ or ‘dual-loop’ refers here to a ruble backed by both gold and commodities.

A New Orthodoxy

Following Patrushev’s remarks about a bar of gold and commodity-backed ruble, the RG interview probes further:

RG Question:

To which Nikolai Patrushev replies:

“

Sanctions – An Own Goal

On the subject of the financial sanctions themselves, and the freezing of Russia’s FX reserves held abroad, Patrushev states that imposing sanctions against Russia, the “”, and has damaged trust in the US dollar as the world’s de facto reserve currency:

The West vs The Rest

Elsewhere in the interview, Patrushev drops some bombshell comments about how Russia is intensifying cooperation with the non-Western world, comments which have yet to be appreciated by the mainstream Western media.

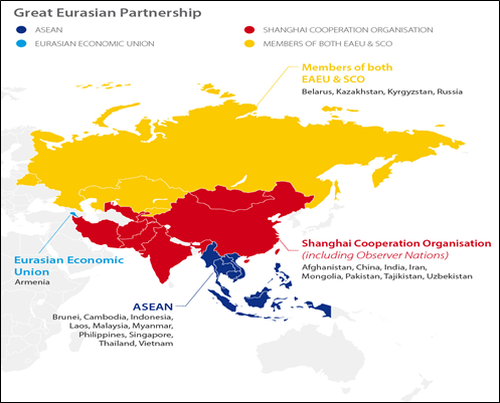

Note – The EAEU refers to the Eurasian Economic Union. The EAEU, which was founded in 2015, is a free-trade zone and customs union comprising Russia, Kazakhstan, Belarus, Armenia, and Kyrgyzstan. See the EAEU website here.

SCO refers to the Shanghai Cooperation Organisation. The SCO, which was founded in 2001, is an international intergovernmental grouping comprising the 8 member states of China, Russia, India, Kazakhstan, Pakistan, Uzbekistan, Kyrgyzstan, and Tajikistan, as well as 4 observer states of Belarus, Iran, Afghanistan, and Mongolia, and a further 6 dialogue partners in the form of Turkey, Azerbaijan, Armenia, Cambodia, Nepal, and Sri Lanka.

BRICS refers to the world’s 5 largest emerging economies and comprises Brazil, Russia, India, China, and South Africa. BRICS was established in 2006 and is now a formal grouping, with the BRICS nations formally cooperating and meeting on an annual basis. The 2022 BRICS summit is being held in China.

EAEU. SCO. BRICS. Three and a half billion people. And now a bar of gold and commodity-backed ruble. Something for the Western media to ponder.

Conclusion – A New Gold Standard?

In late March when the Bank of Russia offered to buy gold from Russian banks at a fixed price of 5000 rubles per gram, this was the first step in linking the ruble to gold. That move also put a floor price under the ruble and acted as a catalyst for the ruble to re-strengthen ground against the US dollar that had been lost in late February / early March.

During the same week in late March, Putin also informed the global market that non-friendly importers of Russian gas would have to pay for Russian natural gas using rubles. That move (which we are now seeing playing out in the EU) was the other side of the equation, linking the ruble to commodities.

This was all laid out in the Q&A article that I wrote for RT.com and which can be seen here on the BullionStar website titled “Russian Ruble relaunched linked to Gold and Commodities — RT.com Q and A“, and which was a big hit on ZeroHedge with more than 650,000 views.

What we are seeing now is Nikolai Patrushev and the Kremlin confirming this simple equation of linking the Russian ruble to gold and commodities. In other words, the beginning of a multilateral gold and commodity-backed monetary system, i.e. Bretton Woods III.

Anyone who wants to read an English translation of Nikolai Patrushev’s full interview with Rossiyskaya Gazeta can do so at this link.

* * *

From: zerohedge As the Federal Reserve attempts to crush aggregate demand through the most aggressive monetary tightening policies in decades to cool red-hot inflation, California Governor Gavin Newsom has come up with the brilliant idea to stoke even more demand through a new round of stimulus checks. NEW: Millions of Californians will be receiving up […]

From: zerohedge China Establishes Liquidity Agreement With BIS, Further Eroding The Dollar | ZeroHedge The concept of eastern opposition to globalist institutions is a fanciful one driven perhaps by people’s hopes that some country somewhere is going to “make a stand” against the agenda. Unfortunately, the vast majority of nations are irrevocably tied to the […]

From: zerohedge Mastercard CEO: SWIFT Payment System May Be Replaced By CBDCs In Five Years | ZeroHedge There has been a long list of revelations coming out of the recent World Economic Forum meeting in Davos, but one issue that might have gone under the media radar involves comments by Mastercard CEO Michael Miebach during […]

By Jackson Elliott of The Epoch Times Modern currencies such as Bitcoin expect to find success in a more technological world, but a new private currency known as Goldbacks might corner the post-apocalyptic currency market. Gold backs in several different denominations In 2019, Goldback president Jeremy Cordon said he had a dream in which he saw people paying for […]