by currencycentr1

Share

by currencycentr1

Share

From: zerohedge

At the end of March, we warned that the “Yen was At Risk Of “Explosive” Downward Spiral With Kuroda Trapped“…

Yen At Risk Of “Explosive” Downward Spiral With Kuroda Trapped… And Why China May Soon Devalue https://t.co/8UbeP36cJL

— zerohedge (@zerohedge) March 30, 2022

…. and that, more or less, is what happened with the Japanese currency subsequently suffering the longest stretch of daily losses in history with 13 consecutive days of losses.

And absent the occasional short squeeze, it is unlikely that this relentless trend lower in the yen trajectory will change any time soon as it comes at the expense of the BOJ’s being able to maintain its Yield Curve Control which limits the 10Y JGB at 0.25%, but to do so, it forces the BOJ to keep easing, injection trillions in yen, and effectively continuously devaluing the currency (until none other than China is forced to devalue as we also explained last month, and will discuss again later today).

So with the BOJ trapped and unable to do much to reverse the implosion in the yen (which unlike much of the past decade is actually dangerous for Japan because as we also explained this week, assures much higher inflation for the country which has the highest debt load in the developed world), what does Japan do? Why come running to the Fed in hopes of some “coordinated intervention” of course.

On Friday, Japanese television broadcaster TBS reported that Japan and the United States likely discussed the idea of coordinated currency intervention to stem further yen falls during a bilateral finance leaders’ meeting. According to Reuters, the report, citing a Japanese government source, came after Japanese Finance Minister Shunichi Suzuki described recent yen falls as “sharp” and said he agreed with U.S. Treasury Secretary Janet Yellen to communicate closely on currency moves.

“We confirmed that currency authorities of both countries will communicate closely, aligning with the exchange-rate principles agreed among the G7 and G20 members,” Suzuki told reporters after the meeting with Yellen in Washington D.C. on the sidelines of the International Monetary Fund gatherings.

Suzuki said he explained to Yellen that recent yen falls were sharp, but declined to comment on whether the two discussed the idea of coordinated currency intervention. However, in a report from Washington, TBS said Suzuki and Yellen did discuss joint currency intervention during their talks.

“The U.S. side sounded as if it would consider the idea positively,” TBS quoted the government source as saying.

That said, it is unlikely that a new Plaza Accord is imminent as Washington will find it very hard to consent to yen-buying intervention as it would drive down the dollar and accelerate already soaring U.S. inflation, TBS reported. When approached by Reuters on the report, a Japanese finance ministry official said he could not comment on whether joint currency intervention was discussed at the meeting.

It’s probably hard to get U.S. consent for coordinated intervention at this timing,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management. “If intervention does take place, that could trigger a huge unwinding of positions and push up the Japanese currency by 2-3 yen in a short period of time.”

The yen has plunged to two-decade lows against the dollar, with the central bank continuing to defend its ultra-low rate policy in contrast with heightening chances of aggressive rate hikes by the U.S. Federal Reserve. read more

The currency’s fall halted this week at lows of 129.43 to the dollar on expectations the issue of joint intervention could be raised at the G7 and the U.S.-Japan finance leaders’ meetings. In a G7 statement issued on Thursday Tokyo time, the finance heads said they were closely monitoring markets that have been “volatile,” but made no mention of exchange rates.

“The government has said rapid currency moves were undesirable. What we’re seeing now with the yen are rapid moves, so we’ll monitor moves closely with a sense of urgency,” Suzuki told reporters.

Investors believe the yen has even further to fall, with most betting that even a government intervention wouldn’t be enough to turn around the momentum.

“It wouldn’t surprise me if they did talk about joint intervention,” though Suzuki likely failed to win consent from Yellen, said Daisaku Ueno, chief foreign exchange strategist at Mitsubishi UFJ Morgan Stanley Securities. “That’s why Suzuki had little to say about what Yellen told him. Given the U.S. battles with rapid inflation through monetary tightening, it’s unthinkable Washington will agree to Japan’s call for intervention.”

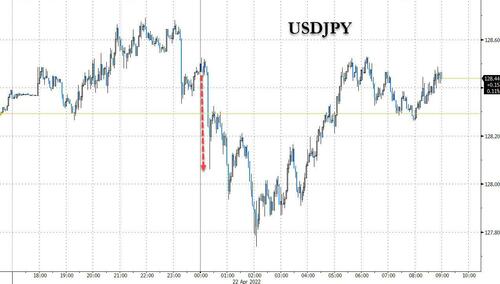

The Yen jumped modestly on the news, briefly reversing the day’s losses with the USDJPY dipping briefly below 128, only to resume it relentless collapse …

… which as we will discuss shortly, is “the biggest story no-one is talking about” according to Albert Edwards.

From Coindesk: FedNow to debut in less than a year (Jesse Hamilton/CoinDesk) The U.S. Federal Reserve has tightened the window for the launch of its FedNow instant payments platform to between May and July of 2023. According to a press release, FedNow will be open to financial institutions of any size, allowing them to facilitate instant […]

From: zerohedge Goldman has reportedly offered its first ever lending facility backed by BTC as the Wall Street giant deepens its Bitcoin offerings. Goldman Sachs has offered its first bitcoin-backed loan. The arrangement, made popular over the past few years in the Bitcoin industry by newer companies, enables a bitcoin holder to obtain fiat money […]

By Jorge Vilches for the Saker Blog Russia is currently “defaulting” or — in the best of cases — on a very direct and firm path to an inevitable “default”. Or at least this seems to be what the Western press and international rating agencies are pushing and rooting for, same as specialized academia, think-tanks, […]

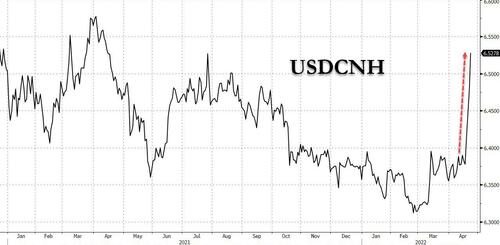

From: zerohedge Three weeks ago, when we predicted that the Yen was about to suffer a “downward spiral” (which it did, and prompted the BOJ to beg Yellen for coordinated currency intervention, only to be denied by the Treasury Secretary who is terrified of what importing even more inflation would mean for Biden’s catastrophic approval […]