by currencycentr1

Share

by currencycentr1

Share

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RVT46AAF6BD7LGEF2Y3BZHYHSU.jpg)

FedNow to debut in less than a year (Jesse Hamilton/CoinDesk)

The U.S. Federal Reserve has tightened the window for the launch of its FedNow instant payments platform to between May and July of 2023.

According to a press release, FedNow will be open to financial institutions of any size, allowing them to facilitate instant payments for consumers and businesses, giving customers immediate full access to funds. The platform is currently in pilot phase with more than 120 organizations participating, including lender U.S. Bank and payment processor Alacriti Payments among them.

Initially announced in August 2020 by then-Fed Governor (now Vice Chair) Lael Brainard, the FedNow platform is seen as a stepping stone to an eventual central bank digital currency (CBDC).

“The benefits of instant payments are increasingly important to consumers and businesses, and the ability to provide this service will be critical for financial institutions to remain competitive,” Ken Montgomery, FedNow Service program executive, said in the central bank’s press release.

From: zerohedge Goldman has reportedly offered its first ever lending facility backed by BTC as the Wall Street giant deepens its Bitcoin offerings. Goldman Sachs has offered its first bitcoin-backed loan. The arrangement, made popular over the past few years in the Bitcoin industry by newer companies, enables a bitcoin holder to obtain fiat money […]

By Jorge Vilches for the Saker Blog Russia is currently “defaulting” or — in the best of cases — on a very direct and firm path to an inevitable “default”. Or at least this seems to be what the Western press and international rating agencies are pushing and rooting for, same as specialized academia, think-tanks, […]

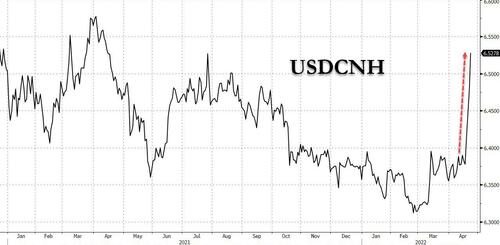

From: zerohedge Three weeks ago, when we predicted that the Yen was about to suffer a “downward spiral” (which it did, and prompted the BOJ to beg Yellen for coordinated currency intervention, only to be denied by the Treasury Secretary who is terrified of what importing even more inflation would mean for Biden’s catastrophic approval […]

From: zerohedge At the end of March, we warned that the “Yen was At Risk Of “Explosive” Downward Spiral With Kuroda Trapped“… Yen At Risk Of “Explosive” Downward Spiral With Kuroda Trapped… And Why China May Soon Devalue https://t.co/8UbeP36cJL — zerohedge (@zerohedge) March 30, 2022 …. and that, more or less, is what happened with […]