by currencycentr1

Share

by currencycentr1

Share

From: zerohedge

Three weeks ago, when we predicted that the Yen was about to suffer a “downward spiral” (which it did, and prompted the BOJ to beg Yellen for coordinated currency intervention, only to be denied by the Treasury Secretary who is terrified of what importing even more inflation would mean for Biden’s catastrophic approval rating), we quoted SocGen’s Albert Edwards who said that the collapse in the Yen”beggars the question how will China react? Maybe just like they did in August 2015 when the PBoC devalued? Back then persistent yen weakness had dragged down other competing regional currencies and left the renminbi overvalued.”

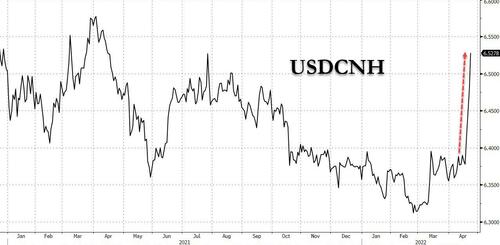

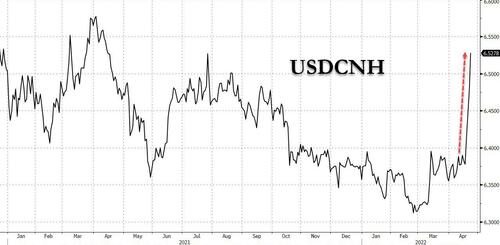

Once again we didn’t have long to wait for this prediction to come true, and one look at the chart below shows what happens when one is hoping to quietly devalue one’s currency from under the dragon’s nose: after weeks of perplexing gains that stumped everyone (and may have been the direct result of Russians buying up Chinese assets), the yuan has collapsed (said otherwise, the USDCNH has soared).

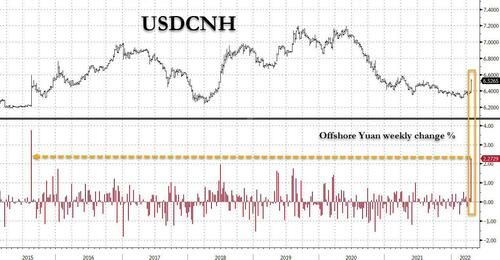

As shown below, the offshore yuan just suffered its biggest weekly loss since the surprise devaluation in August 2015, tumbling 2.1%; the onshore yuan is down 1.9% this week to 6.4899 per dollar. Bloomberg has called the move a “spurring investor concern on whether it’s reaching an inflection point after two straight years of gains.”

Well, of course, it is – after all, China’s economy is in freefall and the last thing it can afford is more currency gains… just as we warned at the end of March. And now that our forecast has been validated, options traders are pricing in much more weakness for the onshore yuan after it breached a key technical support level on Wednesday for the first time since September.

The sharp moves – as we predicted weeks ago – were triggered by the relentless surge in U.S. yields as they threaten to exacerbate outflows from China’s bond market and put the yuan at a disadvantage over the yen. The People’s Bank of China’s decision on Wednesday to set a weaker-than-expected currency fixing also dissuaded yuan bulls, while President Xi Jinping defending the lockdown-dependent approach to fighting the pandemic added to economic growth concerns.

“It does seem that options markets have been surprised,” said Alvin Tan, head of Asia FX strategy at Royal Bank of Canada Plc. “Risk reversals racing higher is a confirmation of the changed market sentiment on dollar-offshore yuan,” Tan said, adding that he doesn’t rule out the offshore yuan falling below 6.60 per dollar by the end of the year if economic risks grow.

And while few are willing to admit that a sharp devaluation like the one in 2015 is possible – or inevitable – the reality is that the CNHJPY is right where it was when China devalued seven years ago.

Looking ahead JPMorgan also expects more weakness and sees the yuan falling to 6.5 per dollar this quarter, weaker than its previous estimate of 6.35. BNP sees the currency falling to 6.6 per dollar, down from an earlier forecast of 6.4. Below, courtesy of Bloomberg, are the charts illustrating the changing sentiment on the yuan:

Surging Activity

Dollar-yuan was the most traded currency pair in the options market for a second day on Thursday taking the week’s total transaction volume to $49 billion. An upward breach through the 6.40 per dollar level and breach of its 200-day moving average support confirm the termination of months of consolidation for the currency, China International Capital Corp. said; this could prompt a new wave of speculation on yuan entering a new trading range, it said.

“The PBOC has been signaling to corporates to be risk-neutral on FX exposures, which should imply a reduction of their dollar longs,” said Arindam Sandilya, head of emerging Asia local markets strategy and FX derivatives strategy at JPMorgan Chase & Co. in Singapore. “This is a bulwark against dollar-onshore yuan depreciation.” Sandilya estimates banks and corporates accumulated about $640 billion dollars over the last two years.

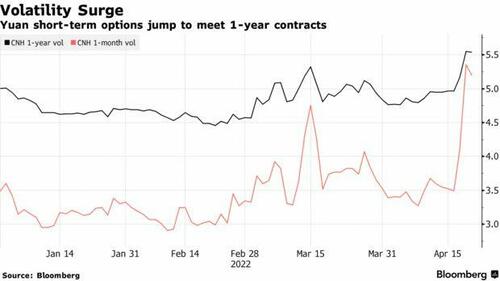

Turbulent Markets

Offshore yuan implied vol shot higher across all tenors after the currency pair broke out of the range it had been in since Oct. 20. One-month dollar-offshore yuan volatility surged to the highest since February 2021 before stabilizing Thursday. A spokeswoman at China’s State Administration of Foreign Exchange reiterated the regulator’s stance on keeping the yuan “stable on a reasonable and equilibrium level.” The exchange rate has been more flexible this year and its two-way movements will continue, she said.

The central bank is less concerned about defending a “magic level”, according to Zhennan Li, chief China economist at AllianceBernstein. It wants to avoid the accumulation of speculative or “herding factors” in the market, he said, adding that “If depreciation expectation keep persistently accumulating, and the pace of depreciation becomes too fast, the PBOC may come out to guide expectation.”

Shorts Piling In

The PBOC set the Thursday reference rate for the Yuan 498 pips higher than the previous day, the largest single-day jump this year. That’s after the central bank’s move to set the reference rate 101 pips weaker than forecast on Wednesday was seen by some traders as a sign of its discomfort with the currency’s strength.

The offshore yuan forwards curve flattened in response to the PBOC’s move Wednesday, allowing for cheaper entry into yuan shorts. The one-year points are close to the lowest in two years as expectations of further policy easing persist even as the loan prime rates were kept steady this week.

Dollar Bets

According to Bloomberg, traders are unwinding structural bets on yuan strength and positioning for a stronger dollar. The one-month risk reversal, a measure of hedging cost, jumped to 1.34% on Wednesday — a level was last seen in November 2020. The risk reversal skew has shifted toward a stronger dollar as traders price aggressive rate hikes by the Federal Reserve.

The momentum is for the yuan to weaken in the near term given the backdrop of broad dollar strength, according to Citigroup Global Markets Inc. strategists. But, it’s too soon to call it a trend reversal. China’s trade surplus, which underpins the currency’s strength is expected to remain large and authorities are likely to leave the yuan to market forces unless volatility gets “unpalatable.”

“President Xi can’t afford to accelerate the weakening of yuan ahead of the plenum in October and midterms in the U.S.,” said Lin Jing Leong senior emerging-market Asia sovereign analyst at Columbia Threadneedle. “It’s all about portraying an image of strength even if it means using the foreign reserves to do so.”

From Coindesk: FedNow to debut in less than a year (Jesse Hamilton/CoinDesk) The U.S. Federal Reserve has tightened the window for the launch of its FedNow instant payments platform to between May and July of 2023. According to a press release, FedNow will be open to financial institutions of any size, allowing them to facilitate instant […]

From: zerohedge Goldman has reportedly offered its first ever lending facility backed by BTC as the Wall Street giant deepens its Bitcoin offerings. Goldman Sachs has offered its first bitcoin-backed loan. The arrangement, made popular over the past few years in the Bitcoin industry by newer companies, enables a bitcoin holder to obtain fiat money […]

By Jorge Vilches for the Saker Blog Russia is currently “defaulting” or — in the best of cases — on a very direct and firm path to an inevitable “default”. Or at least this seems to be what the Western press and international rating agencies are pushing and rooting for, same as specialized academia, think-tanks, […]

From: zerohedge At the end of March, we warned that the “Yen was At Risk Of “Explosive” Downward Spiral With Kuroda Trapped“… Yen At Risk Of “Explosive” Downward Spiral With Kuroda Trapped… And Why China May Soon Devalue https://t.co/8UbeP36cJL — zerohedge (@zerohedge) March 30, 2022 …. and that, more or less, is what happened with […]